Welcome to YourPropFirm’s July update! We are excited to share the latest features and enhancements designed to streamline your management processes and improve our platform’s functionality for prop firm owners. This month, we’ve focused on integrating advanced KYC options, enhancing account management flexibility, and offering new partnership opportunities. Read on to discover the powerful new tools and improvements we’ve introduced.

KYC Integration with Sumsub

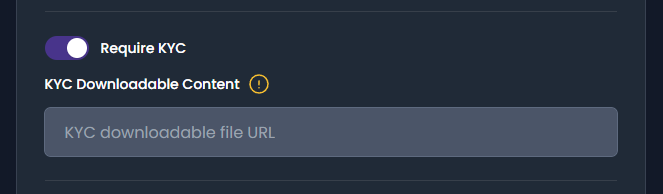

Optional KYC Toggle Requirements for Each Program

Each trading program now has a “Require KYC” toggle. Administrators can decide whether users need to be verified to trade in a specific program. Use this feature wisely, as disabling it will allow accounts in a KYC pending state to skip the KYC step and proceed directly to account creation.

Custom Download Link for Manual Verification

Users can download their verification documents via a custom link. They can then send these documents back to the prop firm through any channel manually. This process can also be managed directly within Sumsub, albeit with additional costs.

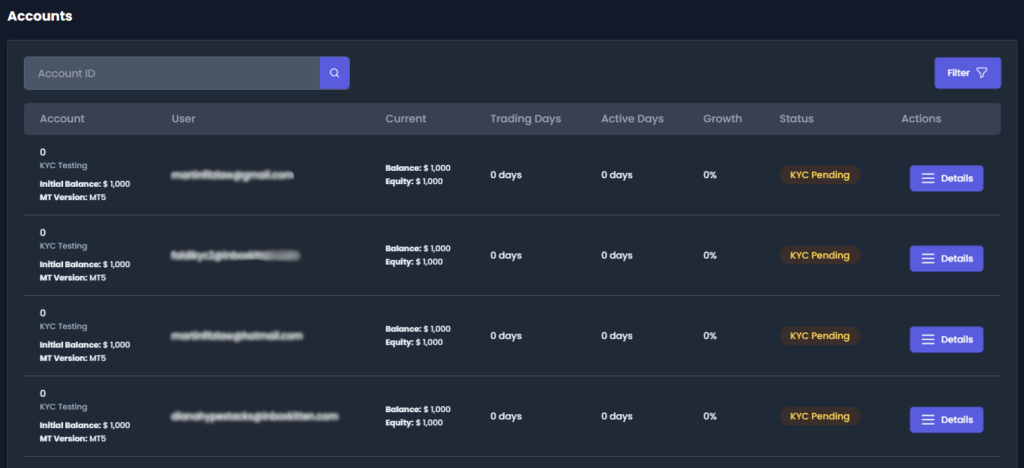

Automatic Account Creation Upon Verification Approval

Once a user’s verification is approved, all accounts with a “KYC pending” status will automatically proceed to account creation. This automation ensures a seamless transition from verification to active trading.

Review Upgrade

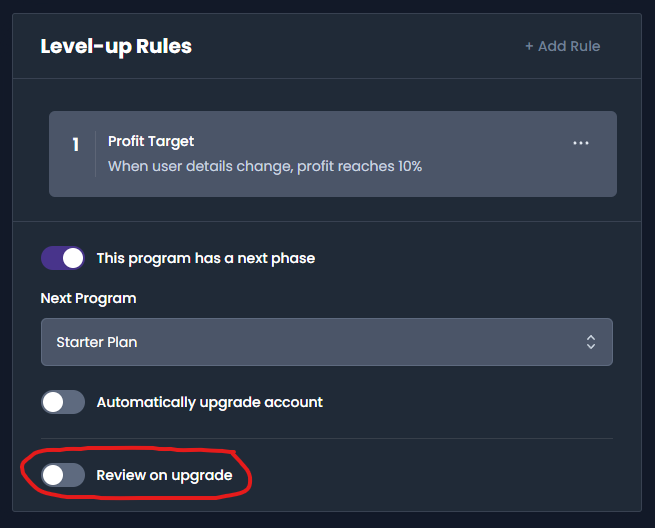

Optional Review on Upgrade Toggle for Each Program

A review toggle in the program setup allows the firm to pause and resume the upgrade process at will. A filter in the menu accounts helps easily identify accounts in the Upgrade Pending state.

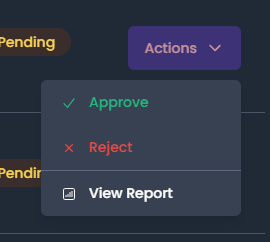

Approve/Reject Upgrade

The option to approve the upgrade lets the user proceed to the next level. If rejected, the account state updates to Upgrade Rejected, and the firm can provide a reason sent to the user’s email, facilitating clear communication.

Enhanced Breach Rules

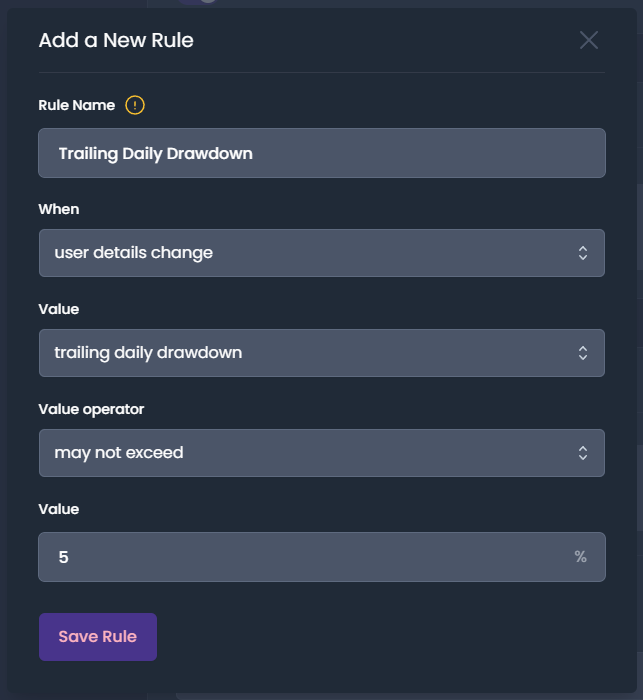

Dynamic Maximum Loss Limits

The maximum loss a trader can incur is now dynamically adjusted based on the account’s peak equity during the day. This ensures effective risk management by protecting the firm’s capital while accommodating the trader’s performance.

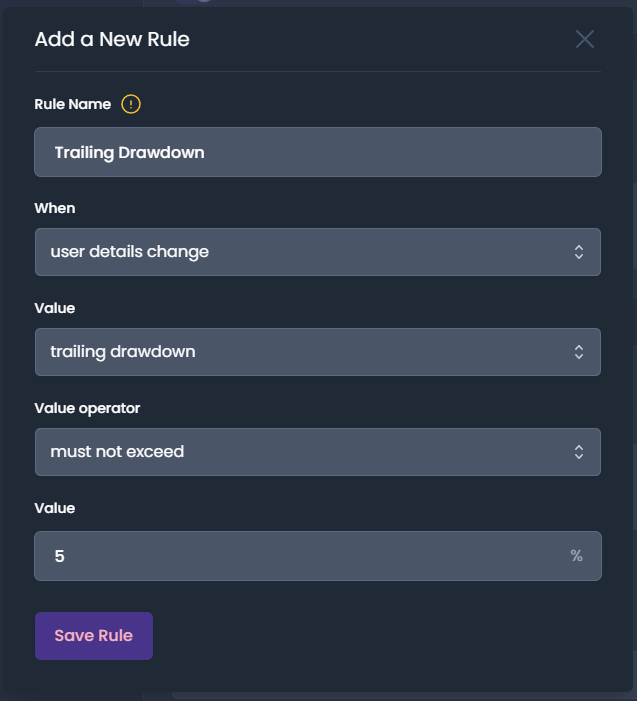

Continuous Trailing Drawdown

The trailing drawdown now continuously adjusts based on the highest account equity achieved since the start of trading. Unlike trailing daily drawdown, which resets daily, this feature provides a dynamic risk management tool that grows with the trader’s account.

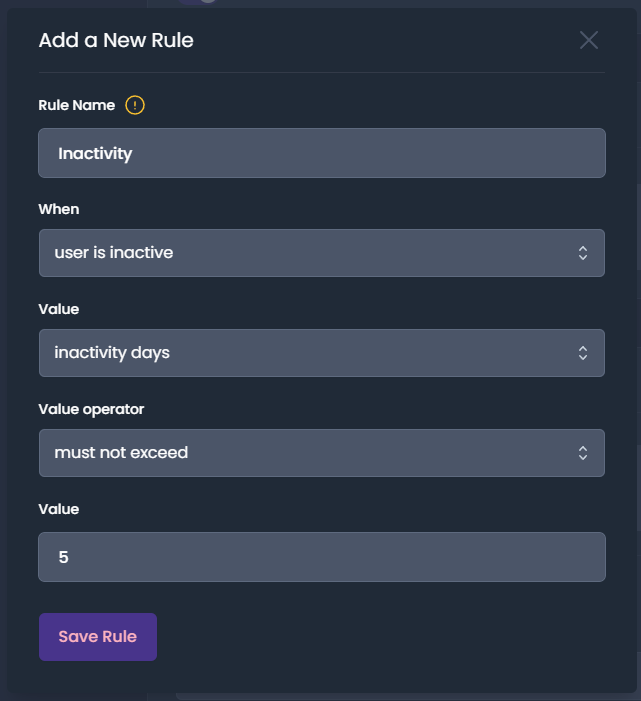

Inactivity Breach

If an account shows no activity within a specified threshold, it will be breached. This breach will result in the disabling of trading abilities in the trading platform, thereby maintaining an active trading environment.

Add-ons

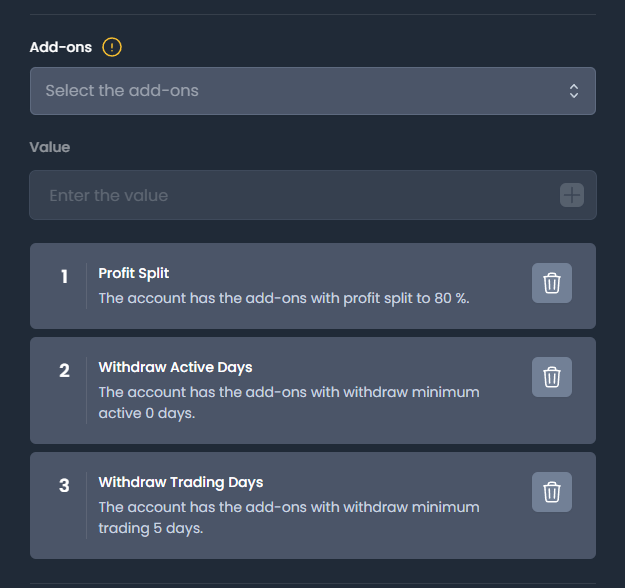

Integration with Account Creation API

The add-ons feature is fully integrated with our account creation API. This integration ensures seamless support for checkout processes in WooCommerce. Users can now select and purchase add-ons during account creation through a streamlined checkout process.

Support for Profit Split Add-ons

Users can now choose profit split add-ons. This feature allows prop firms to customize profit-sharing with users, offering more personalized financial terms that align with their business strategies and goals.

Support for Withdraw Active Days Add-ons

The dashboard now supports add-ons for withdraw active days. This add-on allows prop firms to increase or decrease the payout cycle for users. It provides greater flexibility and control over withdrawal schedules, enhancing the prop firm’s business strategies.

Support for Withdraw Trading Days Add-ons

Additionally, prop firms can opt for withdraw trading days add-ons in the checkout. This feature enables prop firms to extend or decrease the number of trading days included in their withdrawal cycles. It offers more opportunities to capitalize on market conditions and optimize business outcomes.

Account State Update Improvements

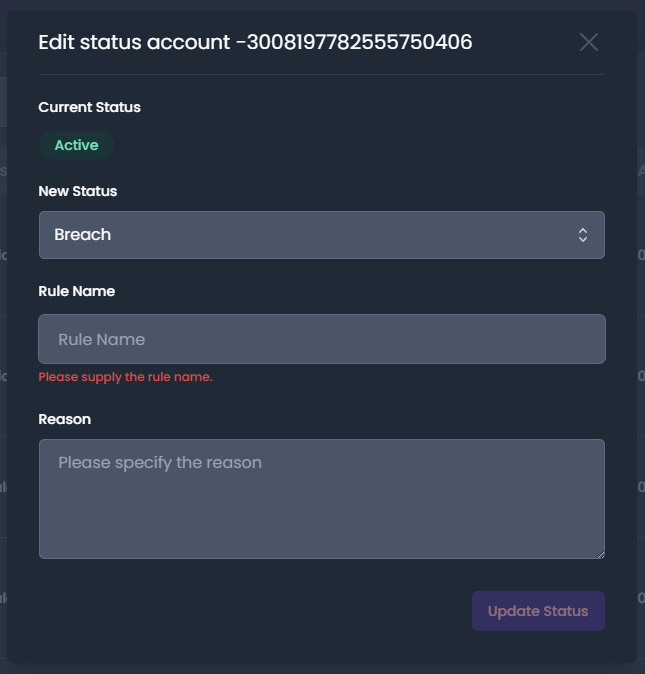

Manual Update to Breached, Upgraded, or Active

Administrators can now update an active account to a breached status. When performing this update, admins can specify the rule name and detail the reason for the breach. This information will be sent directly to the user’s email, ensuring clear communication regarding the status change and the reasons behind it.

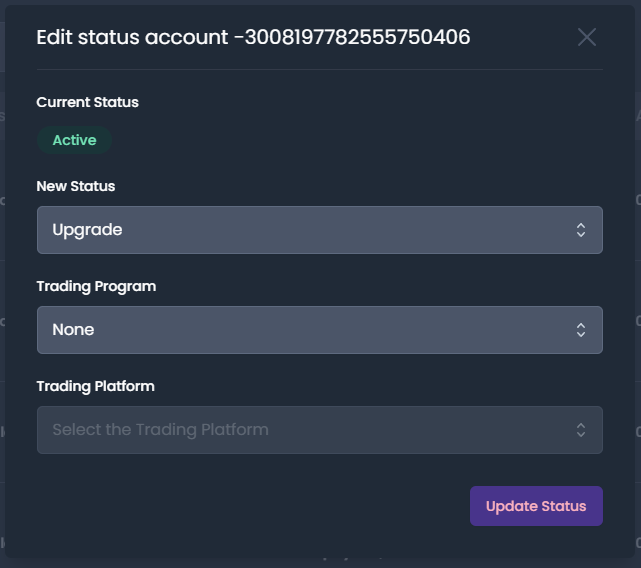

Administrators can also upgrade an active account, advancing the user to the next program level. Admins have the option to select the next program for the user to join or choose to upgrade without assigning a next-level program. This flexibility allows for tailored progression paths based on user performance and admin discretion.

Administrators now have the capability to reactivate breached accounts. When reactivating an account, admins can choose to deposit either the last balance or the initial balance of the account. This option provides flexibility in how account funds are managed upon reactivation, supporting various recovery and restart strategies for users.

Custom Leverage Program

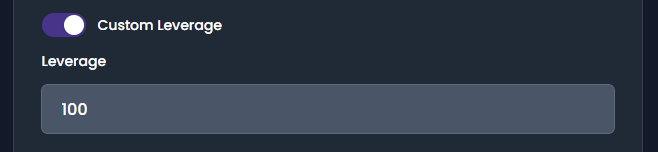

Set Custom Leverage Ratios

We have added the ability to set custom leverage ratios for each trading program, enhancing flexibility and risk management. Access this feature in the Programs section, adjust the leverage settings, and apply changes instantly.

Exciting Partnerships

DXtrade & SiRiX Integrations

Your prop firm clients now have more choices! We’ve finalized the integration with DXtrade and SiRiX, offering a wider range of features and customization options.

Conclusion

As we continue to evolve and expand our platform, we remain committed to providing prop firm owners with the best tools and resources available. The updates introduced this month are designed to enhance your management capabilities, streamline account processes, and offer more flexibility and control. We are excited about the possibilities these new features bring and look forward to your feedback. Stay tuned for more updates next month!