From Trend to Profit: Starting Your Own Prop Firm in 2024

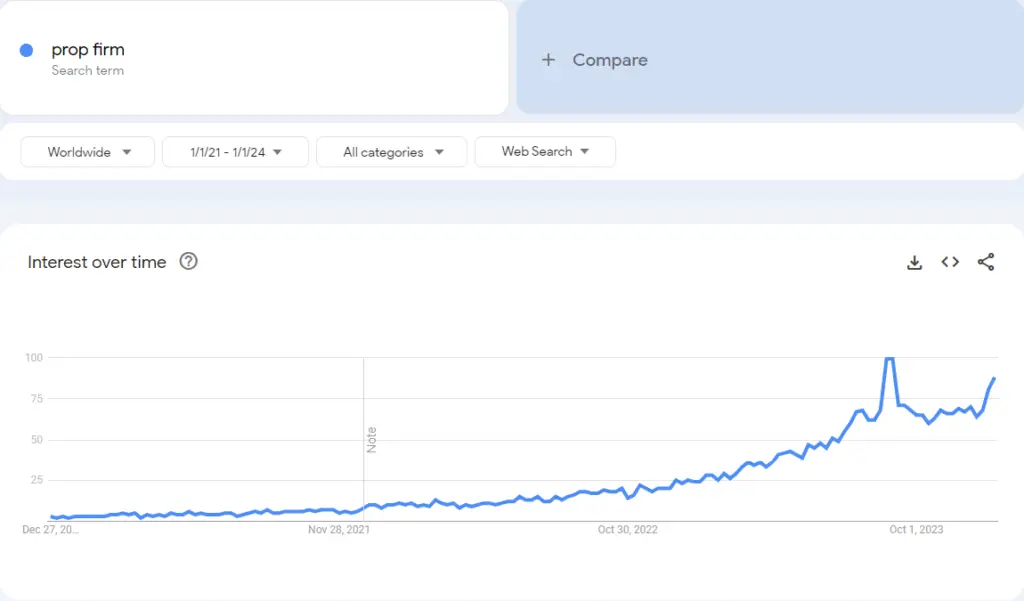

Introduction The world of finance is constantly evolving, with proprietary (prop) trading firms gaining significant attention. This case study explores why 2024 is an ideal time to start a prop firm, drawing on Google Trends data and recent market analyses. Understanding Google Trends Data Google Trends is a tool that shows how often specific terms […]

Why You Should Set Up Your Prop Firm in Hong Kong

Unlocking Prop Trading Opportunities in Hong Kong Hong Kong is increasingly recognized as a prime location for setting up proprietary trading firms, thanks to its favorable business environment and tax regime. The region places a high value on business privacy, with laws that protect company owner information, thereby ensuring a secure and confidential business environment. […]

Boosting Your Prop Firm’s Image: The Power of Positive Content

Introduction In the competitive prop trading landscape, a firm’s success hinges on its reputation, solidified through strategic positive content. This approach not only showcases a firm’s strengths and achievements but also builds a narrative of trust and expertise. By leveraging positive content, prop trading firms can enhance their image, attract top talent, and secure a […]

The Role of Forex Liquidity Providers in Prop Trading Success

Forex Liquidity Providers: Ensuring Smooth Forex Trading Before liquidity providers emerged, executing large trades in the Forex market often led to price disruptions, creating uncertainty and potential losses. Today, with a daily turnover of $7.5 trillion, the Forex market relies on a vital component: liquidity. This essential element enables proprietary trading firms to execute trades […]

Navigating the Consistency Rule in Prop Trading Firms: A Comprehensive Guide

Introduction to the Consistency Rule in Prop Trading Prop trading firms often require traders to follow specific rules to ensure effective risk management and disciplined trading practices. One such requirement is the consistency rule, a key element in the prop trading landscape. The consistency rule mandates that traders maintain a stable trading performance over a […]

Understanding Prop Trading: A Comprehensive Guide to Prop Firms

Introduction to Proprietary Trading Definition and Operational Structure A proprietary trading firm, commonly known as a prop firm, utilizes its own capital to trade in financial markets, distinguishing itself from traditional investment firms that manage client funds. Prop firms are dedicated to generating profits through various trading activities, including but not limited to high-frequency trading, […]

White Label Prop Firm Solutions

Introduction: Unleashing Potential with White Label Prop Firm The concept of white label prop firm is revolutionizing the way traders and entrepreneurs access the financial markets. White label solutions offer a seamless path to launching a proprietary trading firm by providing access to established infrastructure, technology, and support services under your own brand. This innovative approach […]

Blackbull Cuts Funding Pips: MetaQuotes’ Impact

Introduction In the dynamic world of financial trading, a significant shift is happening that could redefine how U.S. clients access popular MetaTrader platforms. MetaQuotes, the powerhouse behind MetaTrader 4 and MetaTrader 5, has begun a crackdown that’s sending ripples across the prop trading landscape. Notably, this shift came into the spotlight with the case of […]

Purple Trading Block on MetaTrader

Purple Trading Blocked By Metatrader The forex market has recently been stirred by the Purple Trading block on MetaTrader, a move that has significantly impacted traders and proprietary firms relying on this platform. These developments have underscored the volatility and unpredictability inherent in the forex trading industry, spotlighting the necessity for a robust and versatile […]

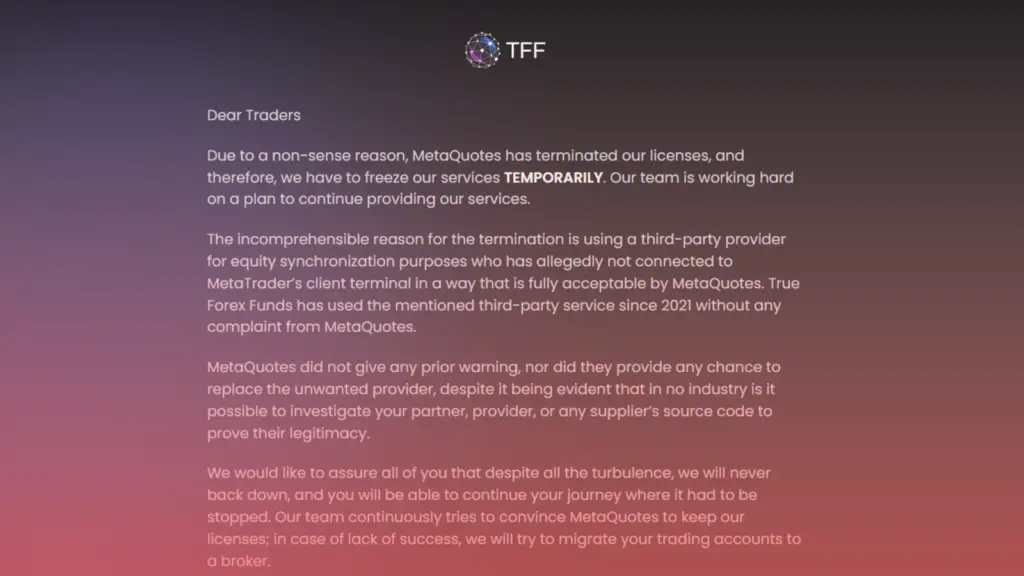

True Forex Funds Case vs MetaQuotes Explained

Introduction of True Forex Funds Case vs MetaQuotes In a surprising turn of events, True Forex Funds (TFF), a notable proprietary trading firm, faced a significant setback when MetaQuotes, the developer behind the popular MetaTrader trading platforms, unexpectedly terminated TFF’s trading license. This action temporarily halted TFF’s operations, sparking confusion and concern within the Forex […]